Blog

- Home

- -

- Blog

Sep

You can’t win the investing game by being pessimistic

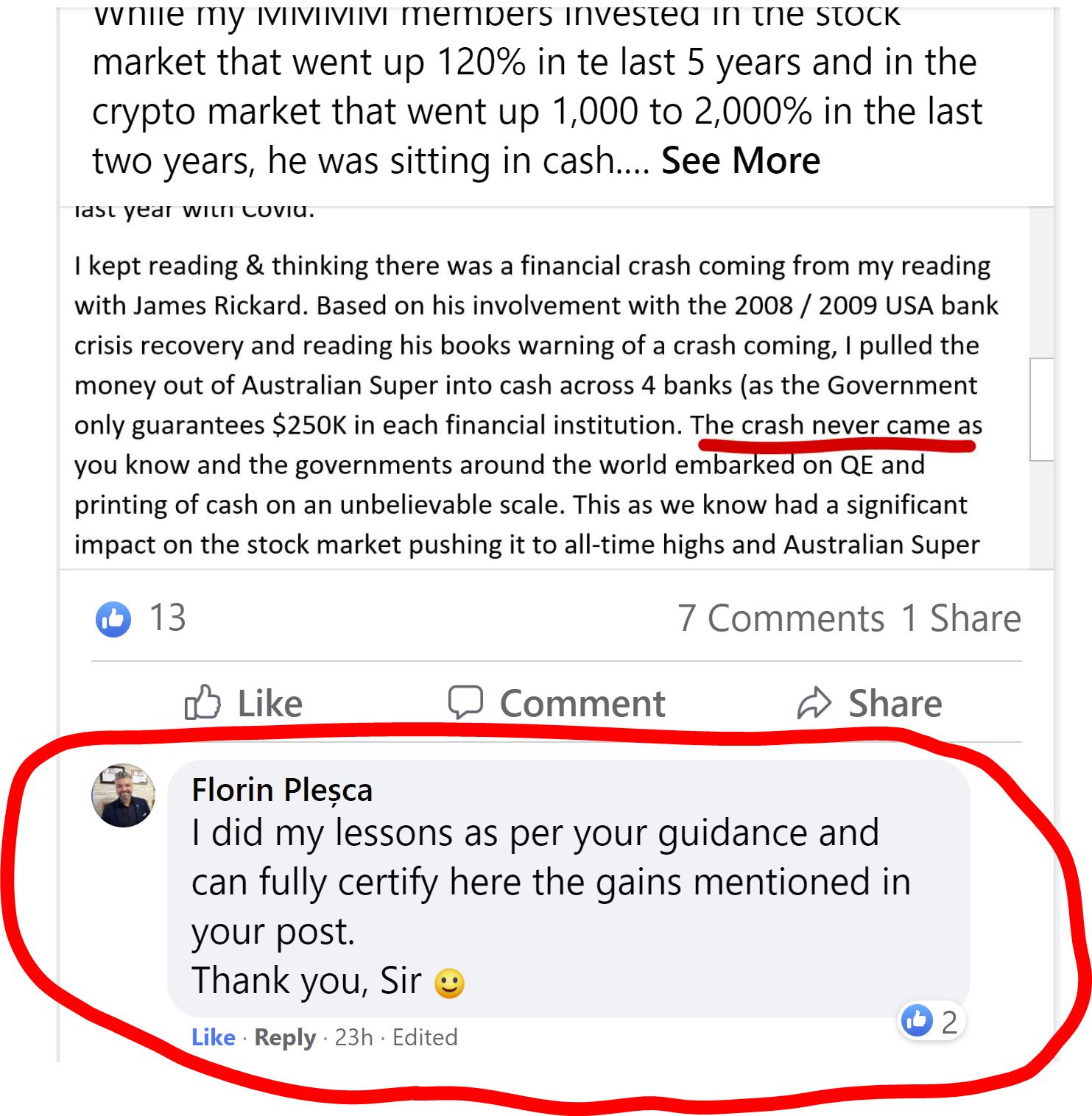

This is an email from one of my new MMMM course members from Australia. In the past he read to many doomsday books and he took his money out of stock funds years ago.

While my MMMM members invested in the stock market that went up 120% in the last 5 years and in the crypto market that went up 1,000 to 2,000% in the last two years, he was sitting in cash.

He had $800k when he did that and now he has the same $800k. By investing that money as per my asset allocation he would now have app. $2 to $3m.

If you are pessimistic about the future, you will never start to invest and the purchasing power of your money will be halved every 8 to 10 years based on the current inflation levels.

When you think about the future, you need to be cautiously optimistic and not pessimistic.

Being pessimistic is a costly thing.

“You will lose all your money if you invest in Bitcoin and the Crypto market”

Famous gold bug Peter Schiff is saying this for years. Now, does this mean that investing in new technologies is a bad idea?

I don’t think so.

Let’s ask ourselves the following questions:

1. What could be the worst thing that can happen if you invest in crypto?

With the exception of options that have a really low probability of happening (Crypto goes to nothing), the worst thing that can happen is that we enter a bear market for 6 months, a year or maybe even two years. And then we go up to reach new heights again.

2. What is the best thing that can happen?

We are going to the moon by the end of this year ![]()

3. What is a the most realistic possibility?

The Crypto market continues to go up and down, with very nice gains over time – just like most new technologies. In the future, Crypto may also ignore the classic 4-year Bitcoin halving cycle. We could easily see this market following the footsteps of the technology stocks but with better gains.

And now the key question: why would I sell?

The only good reason I can find is that you desperately need your crypto money soon.

Othervise I would not even think of selling my crypto assets.

I just don’t want to miss the massive Crypto gains train. I don’t want to wait on the sidelines.

Blockchain technology is a technology that is growing significantly faster than internet tech.

Below you have two charts:

1. Growth in the number of BTC wallets with non-zero balance

2. Growth in the number of ETH walletswith non-zero balance

These numbers are crazy. At the beginning of 2020, there were 34 million such ETH wallets. Today there are 62 million of them.

For BTC, 28 million against 38 million.

Decentralized Finance (financial services without greedy middlemen) will eventually go mainstream. We will all use these services just like we use banks now.

There are some things that DeFi needs to fix (safety, regulation, user experience, …). But it was similar with the internet before 2000. It was slow and awkward, and provided a very limited range of services.

The future of NFTs (digital unique property), virtual worlds, crypto games and other areas is also bright.

In short: in the world of investing, I see no other option for investing the aggressive part of my portfolio (I emphasize the aggressive part, not the entire portfolio) that could have better prospects for the future.

Crypto has by far the best risk vs. reward ratio.

Can the stock market, that was traditionally the most profitable investment, go 5x or 10x in the coming years?

Practically impossible.

Can this happen to Crypto?

I personally think this is very likely.

The price to get these returns is volatility. But volatility is nothing special. Just look at the Tesla share chart in it’s early years:

That’s why I’m happily investing in the crypto market and hodling. And if that is hard, just don’t check the charts in bad times and everything will be OK.